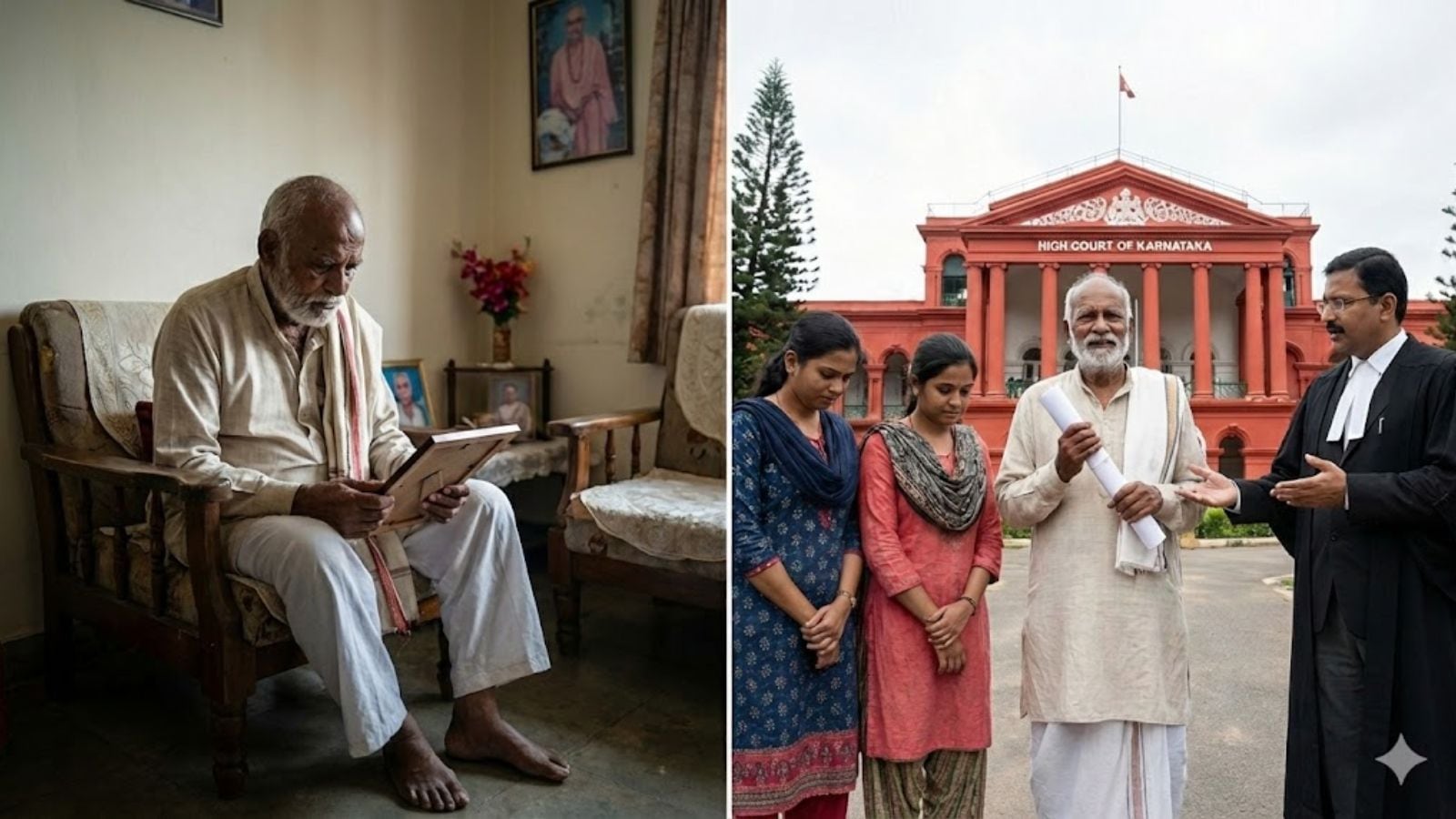

The Karnataka High Court has offered respite to an 84-year-old man by annulling a property gift deed he had executed in favour of his two daughters, who, soon after receiving the property, allegedly started neglecting him and failed to provide food, shelter, and other necessities.

In an order passed on February 2, Justice Suraj Govindaraj declared that the daughters Shivamma (deceased) and Puttamma—to whom their father Venkataiah had gifted his property of over 2 acres in Tumakuru taluk—had obtained the property by misuse of the trust reposed in them by a senior citizen. Thus, the court said, the transfer stands vitiated by constructive fraud on account of failure to honour the assurance, express or implied, of providing care and maintenance to their father.

Venkataiah had approached the high court seeking to set aside the orders passed by authorities rejecting his application made under Section 23 of the Maintenance and Welfare of Parents and Senior Citizens Act, 2007, seeking annulment of the gift deed executed by him in 2023, and to change the revenue entries in his name. He had pleaded that the transfer was made on the assurance that his daughters would take care of his food, shelter, medical needs, and day-to-day well-being during his old age.

Section 23 (1) provides that where any senior citizen who, after the commencement of this Act, has transferred by way of gift or otherwise, his property, subject to the condition that the transferee shall provide the basic amenities and basic physical needs to the transferor and such transferee refuses or fails to provide such amenities and physical needs, the said transfer of property shall be deemed to have been made by fraud or coercion or under undue influence and shall at the option of the transferor be declared void by the (maintenance) tribunal.

Justice Govindaraj refused to agree with the view taken by the authorities that there was no express clause mentioned in the gift deed executed mandating the daughters to take care of Venkataiah.

The court said, in such cases, the circumstances under which the transfer was effected and the subsequent conduct of the transferee would have to be considered while reviewing an application made under Section 23(1) of the Act.

Stating that it was an admitted fact that the gift deed was prepared and drafted by the daughters and Venkataiah was unaware of its contents, as he is illiterate, the court held, “He executed the gift deed solely on the express promise held out by the daughters that they would take care of his well-being.”

Story continues below this ad

Further, the court noted that when a document is prepared exclusively by the donees (daughters), any omission that operates to the detriment of the donor calls for heightened judicial scrutiny, particularly in proceedings under a welfare statute.

‘Trusting nature of senior citizens…a social reality’

The court, in its order, underscored that aged parents rarely insist upon written stipulations, while transferring property to their children. Justice Govindaraj said, “Senior citizens or parents transfer their self-acquired properties, particularly by way of a gift or relinquishment, without consideration in favour of son or daughter. The law must account for the social reality that senior citizens act on trust, familial assurances, and moral expectations rather than on legal formalities.”

Further, the order said, “The trusting nature of senior citizens, especially in rural Karnataka, coupled with the emotional and financial dependence, on children, is a social reality expressly recognised by the Act. To insist upon an express recital of maintenance in every such gift deed would defeat the protective object of the statute and render Section 23 nugatory.”

The court also noted that a welfare legislation, “particularly one enacted to safeguard senior citizens from neglect and exploitation”, cannot be administered in a mechanical or formalistic manner.

Story continues below this ad

Grandson’s claim dismissed

During the pendency of the petition, Puttamma submitted a no objection for the court declaring the gift deed as void. However, the petitioner’s grandson, Narasegowda (son of deceased daughter Shivamma) opposed the petition.

The court accepted the admission made by Puttamma and said that it constituted a substantive corroborative material supporting Venkataiah’s pleading of neglect and breach of obligation.

Rejecting the grandson’s claim, the court said, “Permitting respondent No.6 (Narasegowda) to assert an interest in the property without discharging, or even acknowledging, the obligation to take care for Venkataiah, would amount to conferring a legal advantage which is unaccompanied by statutory responsibility and such an interpretation would defeat the protective purpose of Section 23 and render the statutory remedy illusory.”

Setting aside orders passed by the assistant and deputy commissioner and annulling the gift deed executed as void, Justice Govindaraj said, “An approach that is indifferent to vulnerability, dependence, and misuse of trust not only defeats the object of the statute, but renders its protections illusory.”

Story continues below this ad

Accordingly, the court allowed the application made by Venkataiah and directed the revenue authorities to restore his name as absolute owner of the aforesaid property in all revenue records forthwith.