On January19this year, Bharat Coking Coal Limited (BCCL), India’s largest producer of coking coal and a subsidiary of Coal India Limited listed on the stock market throughan InitialPublic Offering (IPO). Despite challenging global market conditions, the BCCL IPO created capital market history as the highest ever recorded in India’s mainboard IPO market. The 46 crore shares that were on offer to raise anadditional₹1,070 crorereceived over 90 lakh applications and wereoversubscribed147 times. This successful IPO listing of an Indian Public Sector Enterprise (PSE) is not one-off but a trend that has been consistent over the past several years. Over the past 7-8 years, close to 15 Public Sector Undertakings have been listed in the Indianstock exchanges and have not only been able to raise the required money but also create a tremendous amount of shareholder value and retailer wealth.

Shareholder value creation

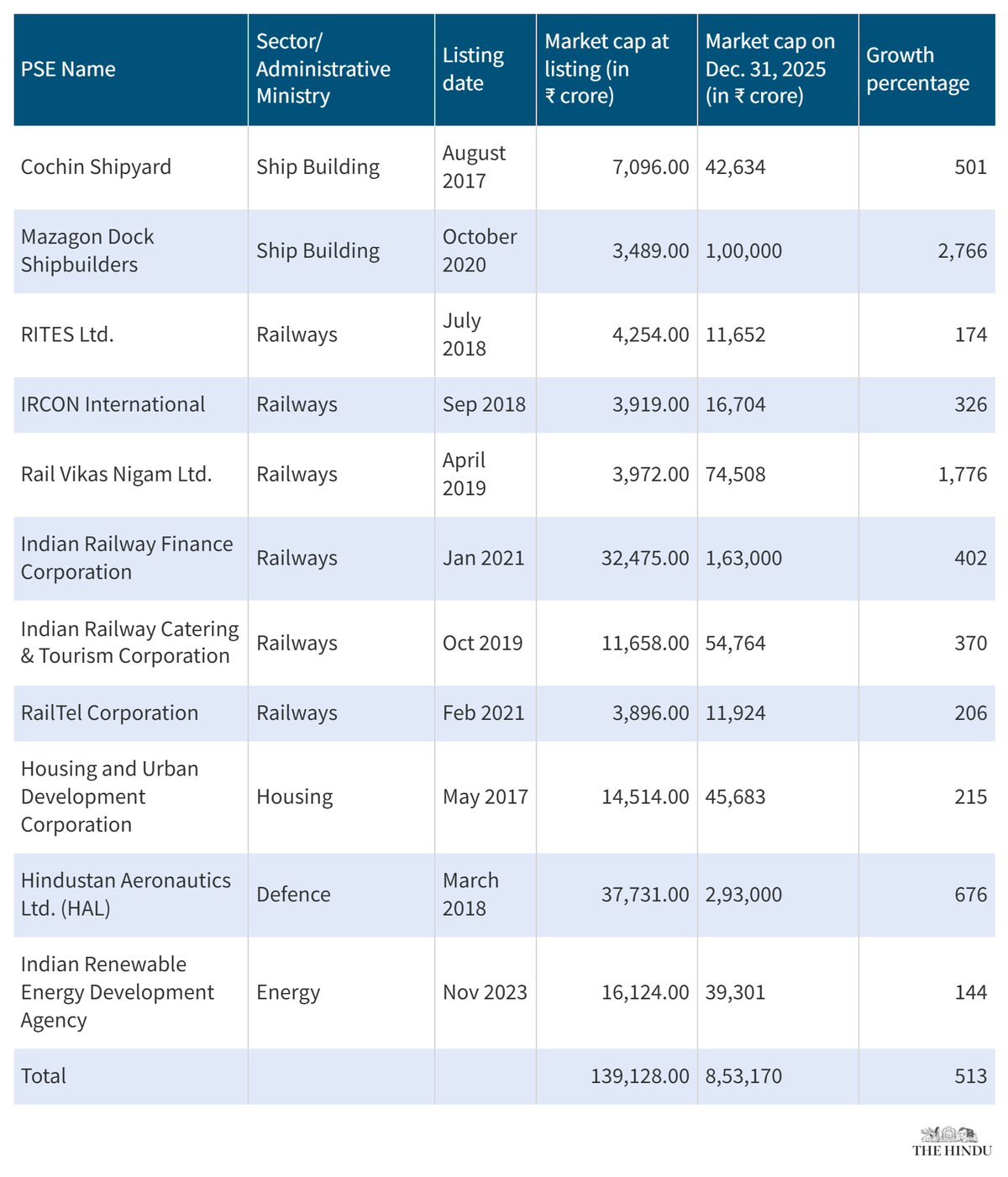

Prior to BCCL, since 2017,India has seen more than 10 large core engineering-, construction-, railways-,defence-,and energy-related PSEs get listed in the stock markets. They have consistently created value for both retail shareholders and the largest owner of PSE stocks— the Government of India. Among the companiesanalysed, the cumulative marketcapitalisationrose from ₹1.4lakhcroreat listingto ₹8.53lakhcroreas on December 31, 2025— awhopping 513% increase.

The companiesanalysedwereCochinShipyard,MazagonDock Shipbuilders, RITES Ltd.,IRCON International,Rail Vikas Nigam Ltd., Indian Railway Finance Corporation, Indian Railway Cateringand Tourism Corporation, RailTel Corporation, Housing and Urban Development Corporation,Hindustan Aeronautics Ltd (HAL), and Indian Renewable Energy Development Agency.

Also read | Coal India arm Bharat Coking Coal IPO subscribed 146.81 times on final day of bidding

While the study excluded services sector IPOs such as banking and insurance whose performances aredriven byadditionalextraneous factors,theGovernmenthas also benefited tremendously from the listing of services-related PSEs.

In summary, the IPO route has not onlyprovidedIndian PSEs robust mechanisms to raise capital for productive use without depending on theGovernment’s budget process but also provide phenomenal returns to theGovernmentand to its retail shareholders.

PSUs funding India’s strategic initiatives

Earlier, Public Sector Undertakings (PSUs) had to rely on budgetary provisions from their administrativeMinistries for capital investments and other expansions. This required extensive discussions with a large group of stakeholders and a longer cycle forrealisingthe money. In today’s age whenthe modern enterprise isrecognisedfor its agility in decision-making and execution, the budget route can no longer be lookedatas the only medium for raising or receiving investments.

Notsurprisingly,a reverse trend has quietly begun to take shape where PSUs have started to fund critical missions. For example, in January 2025, the Ministry of Mines launched the National Critical Mineral Mission (NCMM) to secure a long-term sustainable supply of critical minerals and strengthen India’s critical mineral value chain. The Cabinet approved an expenditure of ₹34,300 crore for NCMM of which only ₹1,500 crore is being sourced from theGovernment‘sbudget. In a truly ‘Whole of Government Approach’,more than 50% of the Mission‘sexpenditure, an amount of ₹18,000 crore, is being funded by PSUs across various administrativeMinistries that include KABIL (Mines Ministry), Coal India Ltd.andNeyveliLignite Corporation India Ltd.(Ministry of Coal), Steel Authority of India and National Mineral Development Corporation (Steel Ministry), NTPC Mining Ltd (Power Ministry), and Oil India and ONGC Videsh Ltd (Petroleum and Natural gas). Quite aptly, the investments being raisedby these PSEs are being plowed into technologies andknow-howthat are being used to reducecoal-basedcarbon emissions.

The above example may now become the norm intheGovernment’s fundingofcritical and strategic missionsin whichthePSEs are tapped in as strategic investors as seen in the NCMM.

Markets as a catalyst for PSU scrutiny and administrative quality

Markets are known to be remarkably brutal and unforgiving as they only reward consistent performance and shareholder value creation. One of the most striking elements of the BCCL narrative is its journey from being perceived as a loss-impacted PSU to a value-driven, strategically critical enterprise. Today, BCCL accounts fornearly 58.5%of India’s domestic coking coal production, placing it at the heart of the steel and infrastructure value chain. This strategic relevance was not lost on investors. In an economy focused on infrastructure expansion, manufacturing growth, and self-reliance, BCCLrepresentsmore than a coal producer; itrepresentsenergy security and industrial continuity.

The success of BCCL should not be seen as a one-off anomaly. The performance of other PSEs is testimonial to a broader shift in how PSE assets are being positioned and perceived. Investors today are increasingly discerning and are willing to back PSEs when they see clarity of purpose, operational strength, and credible execution.PSEs havealso used the recent autonomy granted from their administrativeMinistries and the transparency expected from the reporting framework of market exchanges as an opportunity to bring in administrative quality, strategicplanningand speed in execution. This renewed confidence is already shaping the next phase of PSE market participation as more IPOs are being planned. The old narrative that PSE IPOs are uninspiring has been put torest,and in its place stands a powerful newreality — when the story is real, the markets listen.

Prof. S. Mahendra Dev is presentlyChairman, Economic Advisory Council to the Prime Minister, EAC-PM

Published – January 28, 2026 12:55 am IST